How To Guide For: A Look At Why You Should Never Pay Late Or Miss Monthly Payments & How This Af

- Safi Bello

- Jun 28, 2016

- 1 min read

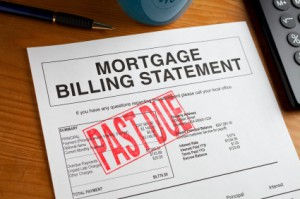

Everyone has expenses that are recurring every month from rent, to mortgage to utilities to credit cards, groceries and so on. But when you miss your monthly payments or pay it late, it can have a huge affect on your credit score and overall finances. Missing a payment or paying late has consequences: the first is that you'll get hit with late fees, the second is your interest rates will go up and third is your credit score will start to decline.

The easiest way to avoid missing a monthly payment and making sure that you never pay late is to set up automatic bill payment.

To learn more reasons why you should never pay late or miss monthly payments and how it affects your credit score and what to do if you find yourself in this situation- please click the pictures below to read the articles.

Comments